DMi Partners Benchmark Study: Early Engager Strategies that Signal Subscriber Success for Publishers

Mar 16, 2021

BRIAN MCKENNA

Vice President of Strategic Partnerships at DMi Partners

ZACH LABENBERG

Vice President of Client Strategy at DMi Partners

Every major email newsletter publisher faces continuous pressure to aggressively grow their email subscriber lists, yet not just any subscriber will do. The cost to capture a subscriber must be measured against their monetization potential. Too often, marketing teams find that their inbound channels do not have the capacity to meet expectations for volume or value.

DMi Partners – a full-service digital agency with a focus on email marketing and acquisition – recently studied which early database acquisition and email strategies delivered and retained new, profitable subscribers. From this effort, DMi was able to pinpoint five key factors that maximize the long-term value of new subscribers and provide benchmarks for each.

DMi examined the email programs of 10 major publisher clients as they commenced new subscriber campaigns. Each program was analyzed for three critical metrics – volume, engagement and effective cost per engaged subscriber. Statistics were collected on how well an opener email performed when sent to a new acquisition target.

Over the course of the benchmark study, DMi Partners managed the acquisition of over 7.5MM new newsletter subscribers for the participating newsletter publishers. The largest of which acquired over 4MM new subscribers for 15 of their branded newsletters across varying focuses including Cooking, Health & Fitness, Parenting, Travel and Lifestyle.

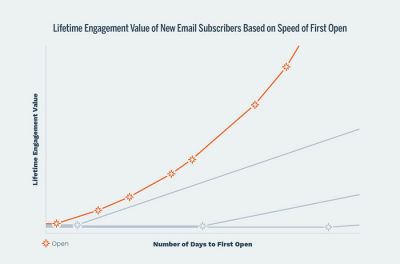

Through this analysis, it was found that the treatment of early engagers – a paid lead who opens an initial email and performs some engagement action – can be directly linked to the long-term value of a subscriber.

PERFORMANCE BENCHMARKS

I.) Expectations for Initial Engagement

Early engagers must be defined through strict expectations to establish their viability. While the definition of engagement will vary, the bar must be clearly measurable and set high.

The programs studied commonly established aggressive criteria for number of opens during a specific timeframe in the early days of a welcome series. A specific example from one study participant called for opens of five of the first eight messages sent. Another publisher expected multiple engagements within the first three to five days that a new email was on file.

Benchmark: An average early engagement open rate of new subscribers enrolled in a welcome series could be set between 28 and 55%.

II.) Expectation for Continued Engagement

Once strong early engagers are identified, they must maintain a stringent level of activity to provide retained value.

Again, a clearly stated criteria for specifying this engagement must be determined. For example, one of the publishers in the study expected that even after 12 months on file 65% of those originally identified as early engagers should have opened an email within the last 30 days.

Benchmark: 62-74% of early engagers should continue to engage with ongoing daily and weekly newsletters, as measured by engagement within the last 30 days for subscribers 12+ months after subscribing.

III) Removal of the Under-Engaged

If publishers set aggressive targets for both initial and continued engagement goals, there will be significant portions of their list that under-engage. These under-engaged subscribers are an expected element of any acquisition campaign (particularly in paid acquisition campaigns).

Newsletter publishers must configure the mechanisms to identify these under-engagers and remove them from ongoing newsletter sends. This should be done to maintain a clean sending reputation and ensure inbox delivery to the engaged subscribers.

While the definition of “under-engager” will vary depending on the program benchmarks and communication frequency, publishers must resist the temptation to retain marginal performers. Recipients who do not reach email engagement guidelines can be entered into re-engagement flows and targeted through other digital channels (programmatic, social, etc.).

Benchmark: 100% of under-engagers (typically defined as new subscribers who haven’t opened within the first 5-8 sends) must be cut from email program but can be re-directed into other engagement efforts.

IV.) Cost Efficiency

While all of the newsletter publishers examined for this report generated the large majority of their revenue from advertisers, the specific revenue models varied significantly.

As such, individual publications had slightly different initial engagement KPI’s they were targeting to ensure they were achieving profitability with their acquisition campaigns.

Benchmark: The following initial engagement KPIs represent where newsletter publishers might target cost efficiency metrics:

- Effective Cost Per New Subscriber:

- $.40 to $.75 goal

- Effective Cost Per Engaged New Subscriber (new subscriber who opened 1+ of initial 4-7 emails)

- $1.15 to $2.50 goal

- Effective Cost Per Avid New Subscriber (new subscriber who opened 5-8 of first 10-12 emails)

- $6 to $9.50 goal

V) Maximizing ROI

Understanding core profitability metrics is the key to driving acquisition effort success. Knowledge of early engagement thresholds and how they correspond with profitability allows publishers to quickly shift marketing dollars and optimize the acquisition sources that consistently sustain early engagement. This allows programs to shift focus to scaling acquisition volume while monitoring performance and responding to shifts in subscriber behavior.

Benchmark: Over time, additional longer-term engagement data is layered on top of the early engagement KPI’s to optimize for sustained engagement. Below are some of the most common metrics utilized:

- Average Open rate in last 30 days

- 3+, 6+ & 12+ months after acquisition

- Active Rate (Opened 1+ emails in last 30 days)

- 3+, 6+ & 12+ months after acquisition

- “Platinum Tier” rate

- % of subscribers that opened 15+, 20+, 25+, etc.

Conclusion

The email newsletter vertical is booming, and with the rise of online platforms that provide publishing, payment, analytics and design infrastructure to support subscriptions, the medium is growing ever more accessible for those publishers who are ready to optimize return on their email newsletters

DMi Partners is committed to facilitating acquisition strategies to accomplish scale, quality and consistency for their clients. Their highly accountable programs establish an immediate proof-of-concept, including a revolutionary Cost Per Lead structure that allows brands to budget to the exact spend needed to achieve their subscriber growth goals.

In 2020 this team delivered publishers over 10MM new subscribers while achieving all cost per engaged lead benchmarks. DMi also managed email acquisition programs for over 50 of America’s leading consumer brands in 2020. Those campaigns will generate over 19.5MM exclusive first party opt-ins collectively.

DMi Partners is a full-service digital agency with a focus on growth marketing. They have excelled in managing campaigns on the forefront of innovation for recognized consumer, B2B and ecommerce brands since 2003. Staffed by big agency talent and offering the personal attention and agility of a boutique, DMi has a proven track record of delivering the highest quality marketing strategy, execution and results.

DMi’s database acquisition and email marketing teams work collaboratively to design subscriber acquisition and growth campaigns for America’s leading consumer brands. Focused on promoting client growth by uncapping the potential of their email marketing programs, they excel at engineering opt-in campaigns that allow brands to significantly expand their marketing reach and best communicate with their target audience.

Learn more by visiting DMiPartners.com or contact info@dmipartners.com.

Brian McKenna, Vice President of Strategic Partnerships at DMi Partners, specializes in designing subscriber acquisition and growth campaigns for America’s leading consumer brands. Brian is a leader in managing cost-effective, high-quality, enterprise-level marketing strategies. His propensity to build longstanding relationships and cultivate client confidence in DMi’s systems and practices has led to enduring partnerships, exemplary results and award-winning campaigns.

Zach Labenberg, vice president of client strategy at DMi Partners, is an industry expert in building subscriber acquisition campaigns and facilitating list growth goals without jeopardizing engagement rates. Focused on promoting client growth by uncapping the potential of their email marketing programs, Zach excels at engineering opt-in campaigns that allow brands to significantly expand their marketing reach and best communicate with their target audience.